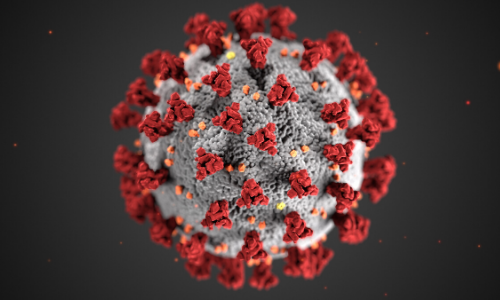

COVID-19 (Coronavirus) is indeed a rampant virus, adversely affecting even the health of our nation’s economy. It has infiltrated every sector, including traditional medicine.

Hospitals nationwide have limited or banned elective surgeries, mandating that beds, equipment, and staff be reserved for potential outbreaks of the virus. In Utah, two of the state’s largest hospital providers, Intermountain Healthcare (IHC) and University of Utah Health, temporarily closed their doors mid-March to nonessential services. Likewise, all hospitals in Washington were ordered to forego noncompulsory care by the governor on March 19th. Without elective surgeries, many of the state’s rural facilities have suffered financial distress, inspiring the Washington State Hospital Association to formally request grants to avoid closures. Sadly, this story is much the same for countless hospitals across the country.

Providers have also taken a financial hit from these and other measures. Without operating rooms, surgical schedules have been upended, resulting in lost revenue for physicians and clinics. Social distancing has kept patients from routine office visits, dramatically reducing traffic for specialists like orthopedists, plastic surgeons, pediatricians, and more. In addition, the highly contagious nature of Coronavirus has replaced in-office visits with telemedicine to limit contact and exposure. These visits are considered lower-tiered, which means reduced payouts for providers.

To combat the effects of COVID-19, the U.S. Department of Health and Human Services (HHS) recently enacted the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $100 billion stimulus package for medical centers and workers. This package offers relief payments to practices impacted by Coronavirus and does not require an initial application. (Note: These are payments, not loans, and will not need to be repaid. HHS has attached restrictions to the acceptance and use of the funds. See the complete list here.)

On April 10th, the first $30 billion installment of CARES funding was made to healthcare providers enrolled in Medicare. Relief payments were calculated according to a provider’s share of total Medicare fee-for-service (FFS) reimbursements for 2019. These funds were either:

- Auto-deposited to a provider’s billing organization by its Taxpayer Identification Number (TIN) via a payment description of “HHSPAYMENT,” or

- Mailed as a paper check, which should arrive within the next few weeks. (Note: The method of delivery was based on the provider’s preference for receiving Medicare reimbursement.)

According to HHS, the remaining $70 billion will be focused on “providers in areas particularly impacted by the COVID-19 outbreak, rural providers, providers of services with lower share of Medicare reimbursement or who predominately serve Medicaid population, and providers requesting reimbursement for the treatment of uninsured Americans.”

Besides this, HHS and several other Federal Agencies have also released additional CARES Act programs to allow physicians to apply for loans as a means of temporarily bolstering funds. This includes:

- Accelerated and Advance Payments Program. Qualified providers may apply for the expedited payment of claims during times of national emergencies or natural disasters. The amount is variable, based on criteria established by the Centers for Medicare & Medicaid Services (CMS) and requested by the provider via the application process. These monies are considered loans, and as such, must be repaid.

- Paycheck Protection Program. Physicians can also apply for the Paycheck Protection Program, a Small Business Association (SBA) loan designed to help cover two months of fixed costs. These loans can potentially be forgiven if all employees are kept on payroll for the eight-week period. The money must also be used for “payroll, rent, mortgage interest, or utilities.”

Though the COVID-19 crisis is far from over, these programs will temporarily alleviate the sting of lost income for both hospitals and providers. Time will eventually lead to answers, cures, and resilience. Until then, may we escape the grasp of this unprecedented virus, physically and economically.

Contact us today to learn more about stimulus packages and other ways to give your clinic an economic boost.